Property Tax In Mississippi After 65 . This exempts the first $7,500 in assessed value from taxation, up to a. what is property tax? exemptions for persons over 65 years of age and disabled. homeowners may also be eligible for the mississippi homestead exemption. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. Evidence that shows the date. Lawmakers are examining a bill that would give. persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. — mississippi homeowners over the age of 65 could get a break on property taxes next year.

from topforeignstocks.com

exemptions for persons over 65 years of age and disabled. — mississippi homeowners over the age of 65 could get a break on property taxes next year. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. what is property tax? persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. Lawmakers are examining a bill that would give. This exempts the first $7,500 in assessed value from taxation, up to a. Evidence that shows the date. homeowners may also be eligible for the mississippi homestead exemption.

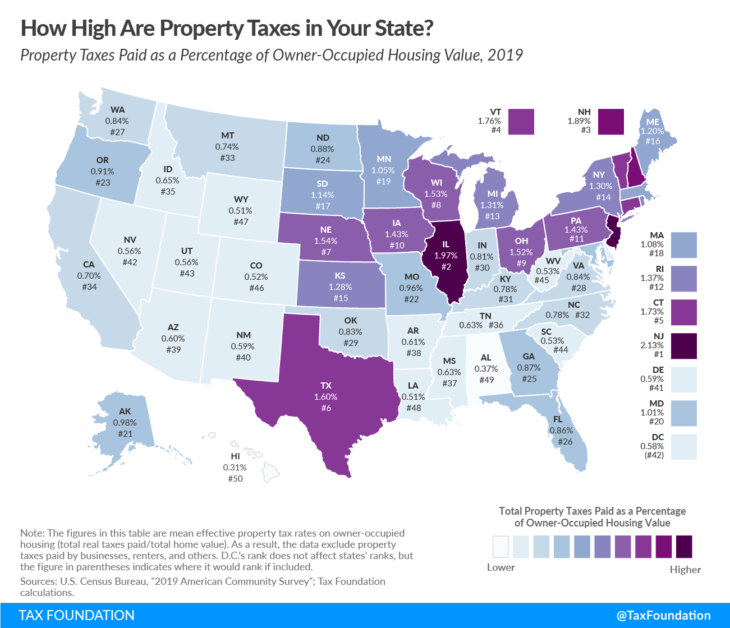

Property Taxes by State Chart

Property Tax In Mississippi After 65 — mississippi homeowners over the age of 65 could get a break on property taxes next year. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. — mississippi homeowners over the age of 65 could get a break on property taxes next year. what is property tax? exemptions for persons over 65 years of age and disabled. persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. Evidence that shows the date. Lawmakers are examining a bill that would give. This exempts the first $7,500 in assessed value from taxation, up to a. homeowners may also be eligible for the mississippi homestead exemption.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax In Mississippi After 65 Lawmakers are examining a bill that would give. — mississippi homeowners over the age of 65 could get a break on property taxes next year. what is property tax? persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. Evidence that shows the. Property Tax In Mississippi After 65.

From www.taxpolicycenter.org

Three State Tax Cut Lessons for 2023 Tax Policy Center Property Tax In Mississippi After 65 This exempts the first $7,500 in assessed value from taxation, up to a. — mississippi homeowners over the age of 65 could get a break on property taxes next year. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. Lawmakers are examining. Property Tax In Mississippi After 65.

From taxpreparationclasses.blogspot.com

Mississippi Tax Rate Tax Preparation Classes Property Tax In Mississippi After 65 what is property tax? exemptions for persons over 65 years of age and disabled. homeowners may also be eligible for the mississippi homestead exemption. This exempts the first $7,500 in assessed value from taxation, up to a. — mississippi homeowners over the age of 65 could get a break on property taxes next year. Lawmakers are. Property Tax In Mississippi After 65.

From www.accountingtoday.com

20 states with the lowest realestate property taxes Accounting Today Property Tax In Mississippi After 65 Evidence that shows the date. exemptions for persons over 65 years of age and disabled. homeowners may also be eligible for the mississippi homestead exemption. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. persons who are 65 years of. Property Tax In Mississippi After 65.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Property Tax In Mississippi After 65 Lawmakers are examining a bill that would give. what is property tax? Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. Evidence that shows the date. exemptions for persons over 65 years of age and disabled. homeowners may also be. Property Tax In Mississippi After 65.

From www.pinterest.com

Types Of Taxes, Property Tax, Tax, Burden, Chart, Arkansas, Mississippi, Virginia Property Tax In Mississippi After 65 persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. Lawmakers are examining a bill that would give. what is property tax? Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on. Property Tax In Mississippi After 65.

From www.statepedia.org

Mississippi Individual Tax Complete Guide Property Tax In Mississippi After 65 This exempts the first $7,500 in assessed value from taxation, up to a. what is property tax? Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. exemptions for persons over 65 years of age and disabled. homeowners may also be. Property Tax In Mississippi After 65.

From www.dallasprobatelaw.com

Deferring Property Taxes for Those Over Age 65 Pyke & Associates PC Property Tax In Mississippi After 65 homeowners may also be eligible for the mississippi homestead exemption. This exempts the first $7,500 in assessed value from taxation, up to a. what is property tax? Evidence that shows the date. exemptions for persons over 65 years of age and disabled. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession. Property Tax In Mississippi After 65.

From itep.org

How the House Tax Proposal Would Affect Mississippi Residents’ Federal Taxes ITEP Property Tax In Mississippi After 65 Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. what is property tax? This exempts the first $7,500 in assessed value from taxation, up to a. persons who are 65 years of age and older or who are disabled, upon application. Property Tax In Mississippi After 65.

From www.payrent.com

How to Calculate Mississippi Property Tax 2024 PayRent Property Tax In Mississippi After 65 persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. Lawmakers are examining a bill that would give. homeowners may also be eligible for the mississippi homestead exemption. This exempts the first $7,500 in assessed value from taxation, up to a. exemptions for. Property Tax In Mississippi After 65.

From topforeignstocks.com

Property Taxes by State Chart Property Tax In Mississippi After 65 — mississippi homeowners over the age of 65 could get a break on property taxes next year. exemptions for persons over 65 years of age and disabled. what is property tax? Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the.. Property Tax In Mississippi After 65.

From dxowscmuw.blob.core.windows.net

Oxford Ms Property Tax at Samantha Hall blog Property Tax In Mississippi After 65 homeowners may also be eligible for the mississippi homestead exemption. what is property tax? persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. exemptions for persons over 65 years of age and disabled. Evidence that shows the date. Property tax, or. Property Tax In Mississippi After 65.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax In Mississippi After 65 persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. what is property tax? This exempts the first $7,500 in assessed value from taxation, up to a. homeowners may also be eligible for the mississippi homestead exemption. Lawmakers are examining a bill that. Property Tax In Mississippi After 65.

From www.youtube.com

How Mississippi Property Taxes are calculated & other home ownership costs Living in Jackson Property Tax In Mississippi After 65 homeowners may also be eligible for the mississippi homestead exemption. Evidence that shows the date. — mississippi homeowners over the age of 65 could get a break on property taxes next year. what is property tax? Lawmakers are examining a bill that would give. Property tax, or ad valorem tax, is a tax imposed on the ownership. Property Tax In Mississippi After 65.

From taxfoundation.org

Estate and Inheritance Taxes by State, 2017 Property Tax In Mississippi After 65 Evidence that shows the date. persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad. This exempts the first $7,500 in assessed value from taxation, up to a. — mississippi homeowners over the age of 65 could get a break on property taxes next. Property Tax In Mississippi After 65.

From www.annuityexpertadvice.com

What Is Estate Tax (2024) Property Tax In Mississippi After 65 Lawmakers are examining a bill that would give. homeowners may also be eligible for the mississippi homestead exemption. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. — mississippi homeowners over the age of 65 could get a break on property. Property Tax In Mississippi After 65.

From itep.org

Mississippi Who Pays? 7th Edition ITEP Property Tax In Mississippi After 65 This exempts the first $7,500 in assessed value from taxation, up to a. exemptions for persons over 65 years of age and disabled. Lawmakers are examining a bill that would give. Property tax, or ad valorem tax, is a tax imposed on the ownership or possession of property and is generally based on the value of the. what. Property Tax In Mississippi After 65.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Property Tax In Mississippi After 65 — mississippi homeowners over the age of 65 could get a break on property taxes next year. homeowners may also be eligible for the mississippi homestead exemption. exemptions for persons over 65 years of age and disabled. Lawmakers are examining a bill that would give. persons who are 65 years of age and older or who. Property Tax In Mississippi After 65.